Buying a home is the most significant financial commitment for most of us.

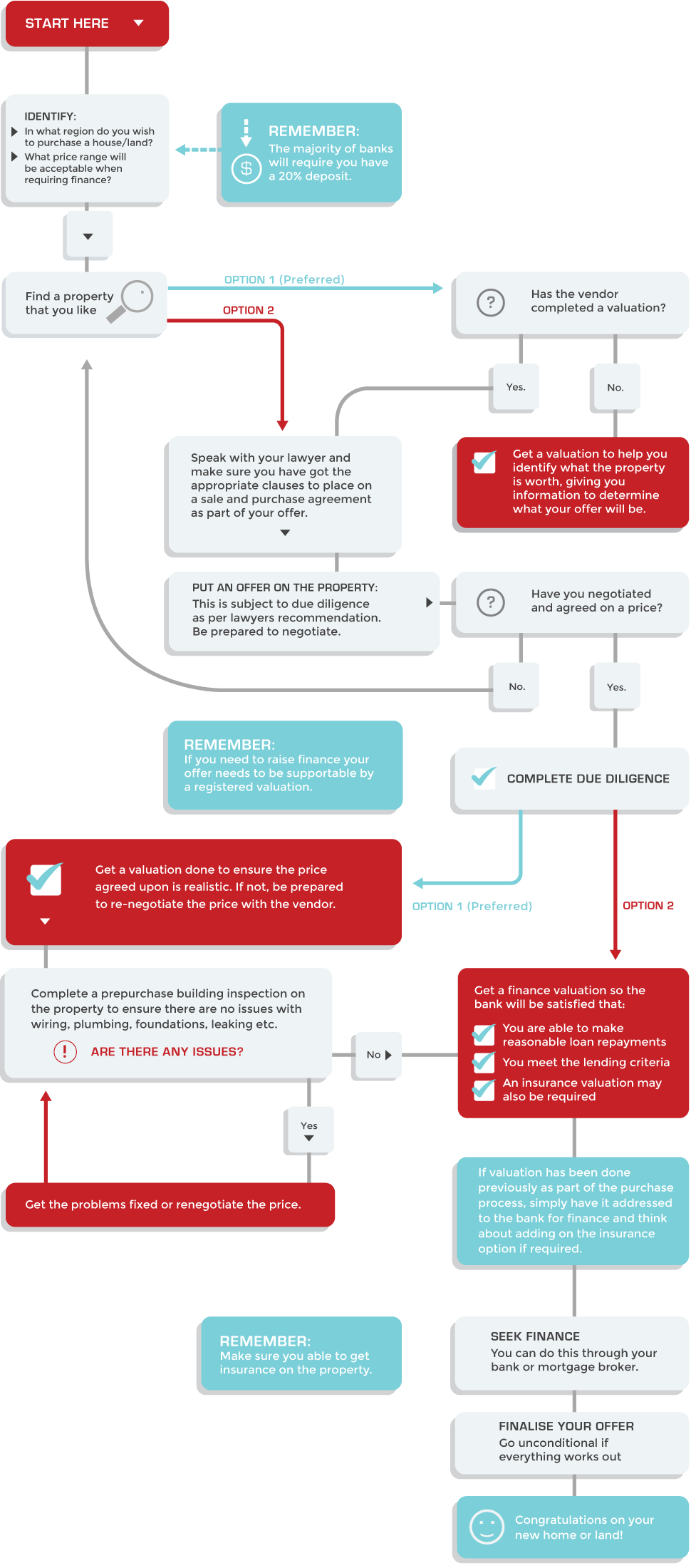

You’ve found a house or piece of land you love. But how do you know how much it’s really worth and what offer to make?

Talk to us, New Zealand’s residential valuation specialists, and we’ll help you through the process.

A Property InDepth valuation report will provide you with not only the home’s value but also detailed information about the property, the legal and zoning aspects of the property, and commentary specific to the market in which the property sits – valuable information that will enable you to buy or sell with confidence.

Banks or other financial institutions often require a registered valuation to satisfy lending criteria. With the new LVR (Lending to Value Ratio) requirements, you may also be asked to provide a registered valuation to borrow money if your deposit is insufficient.

If you don’t get a registered valuation before making an offer on your dream home, we recommend you make your purchase agreement ‘subject to valuation’. That way, if our valuation confirms it may be worth less than you thought, you can renegotiate.

A Property InDepth registered valuation will give you confidence and security to move ahead with a potential house or land purchase.

For independent advice from valuation specialists, call us 0800 463 378 or if you’d like to book your valuation online, you can do it here.